“Perhaps with a bias, I don’t believe anyone knows what the market is going to do tomorrow, next week, next month, next year. I know America’s going to move forward over time, but I don’t know for sure and we learned this on Sept. 10, 2001. And we learned it a few months ago in terms of the virus. Anything can happen in terms of markets. And you can bet on America but you’re going to have to be careful about how you bet. Simply because markets can do anything.”

Warren Buffett

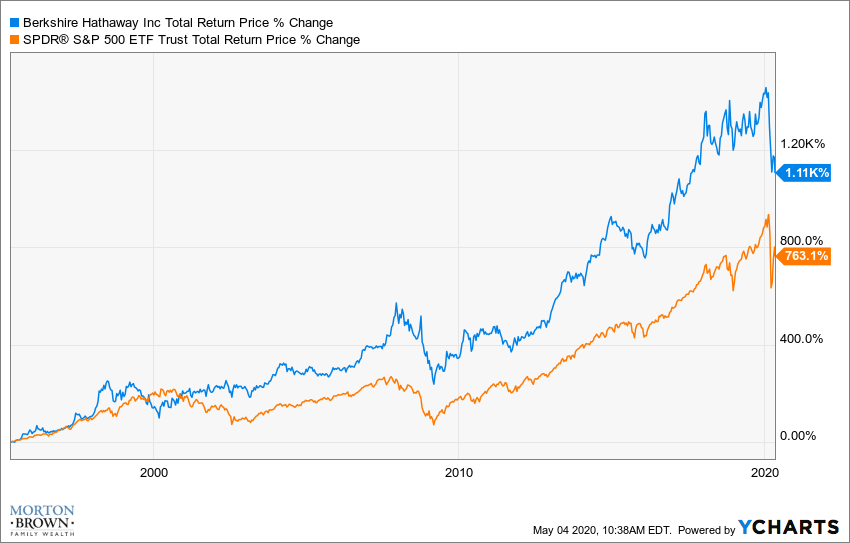

This is how one of the wisest investors of this or any generation broke his silence about the COVID-19 pandemic. Addressing an empty arena on Saturday in his home of Omaha, Nebraska, Warren Buffett channeled the humility and optimism that have defined his investing career. Listening to Buffett was a reminder of why Berkshire Hathaway has made so much money for its investors over the decades. The chart below shows the total return for Berkshire Hathaway versus the S&P 500 over the last 25 years.

The investing success of Warren Buffett and his partner, Charlie Munger, stems from supreme confidence in what they know, and what they don’t know. That second part, what he doesn’t know, is a humility that he has maintained about short term-predictions throughout his career. Uncertainty about the near-term is also why Buffett had been so quiet of late.

Warren BuffetT Breaks Silence

In Vanity Fair last month, William Cohan, remembered how Buffett had been out in front during the Great Financial Crisis. He assured investors and the American public of two things: America always gets through challenges and that he was buying stock in American companies. This time is different as Buffett had said very little about his outlook or Berkshire Hathaway’s activity before this week. One of Cohan’s sources speculated that “Maybe he doesn’t want to be the hero this time around.” After Buffett’s remarks on Saturday, it sounds like that is true. To use its Chairman’s own words, Berkshire has yet to be greedy when others are fearful as it has so often in the past. In fact, Berkshire sold its entire stake in multiple airlines, reflecting that the distance between the humble uncertainty of the near-term and optimism for the long-term might be wider than in past crises.

The reluctance to invest heroically makes sense when we compare our expectations for financial expertise and medical expertise. Since the beginning of this crisis, we have looked to the medical community and policy experts to tell us what will happen next, and what we should do about it. The time horizon for these predictions is not one year from now or five years from now. Now we are asking: “What will happen next week?” And, “What should we do now?”

How to invest in a financial crisis

Listening to the wisest doctors in the world, you can sense their frustration when asked to predict short-term outcomes or the absolute best course of action. They know what Warren Buffett knows, that no one can predict short-term events with any certainty. Grasping for accurate predictions can lead us to be frustrated or, worse yet, totally wrong.

We can learn three things from true experts in any field, be it Warren Buffett or Dr. Anthony Fauci, about how to invest in a crisis: Humility, Optimism, and Informed Action.

- Humility: How to think about now. “I don’t know” is not a sign of weakness, nor does it remove our responsibility to act. If we expect the experts to be heroically right at times like this, we are asking the impossible of them. It is why the best financial advisors will not invest all of their client money in one asset class or one stock. The bet is too uncertain and the stakes are too high. Investing and biology have a lot in common as both markets and biological systems evolve and adapt to new conditions. The quest to be too certain too early with a virus or a market event increases the odds that we can be heroically wrong, with dire consequences.

- Optimism: How to think about the future. In the absence of certainty, all is not lost, though. In his wisdom, Buffett also shares the positive long-term outlook that has been present through each crisis of his career. He believes in the resilience, adaptability, and long-term success of the American economy. How has Buffett succeeded where others fail? His preferred holding period for the businesses that he owns is “forever.” He is confident that while individual companies may come and go, the dynamic economy of the country will continue to reward long-term investors. If we sense some pessimism from him this time around, it is due to the unprecedented nature of these events. We just don’t know how long conditions will be dire before that better version of America arises. If you listen closely, you can hear that same optimism from many medical experts right now. The near-term news is bad. However, in the long-term we not only survive but thrive and are better prepared for the next crisis. Unfortunately, we will still be asking for predictions about what will happen next and, unlike Warren Buffett, the medical experts will not have the luxury of maintaining silence.

- Informed Action: How to act prudently. The recently departed Neil Peart from the rock band Rush penned the lyric, “If you choose not to decide you still have made a choice.” Scooping up shares of financial institutions in 2008 was a thoughtful choice by Berkshire Hathaway. So too, is deciding not to buy companies in 2020 and sitting on a cash hoard of $137 billion.

The right moves are not the same for investors from one crisis to the next.

Warren Buffett invests like someone who:

- Only wants to own stock.

- Has an infinite time horizon.

- Has billions in cash on the sidelines.

- Has no debt.

Compare that to you or someone you know who has:

- A need for retirement income.

- A business that provide for the family’s wealth and income.

- A finite lifespan.

- Multiple retirement and investment accounts.

Sitting still is sometimes the right thing to do. But to follow Warren Buffett’s lead in making investing and planning decisions misses the true value of his wisdom. One of the greatest investors who ever lived is thinking and behaving in a way that we can model. Be mindful of the traps of overconfidence and pessimism. When the time comes to act, do so from a place of confidence about your needs now and in the future.

If you have questions about investing during this precarious time, feel free to reach out.

Morton Brown Family Wealth LLC is a registered investment adviser. This information is not provided as legal or tax advice but for information purposes only. Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk and therefore can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Morton Brown Family Wealth (“Morton Brown”), or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Morton Brown. Please remember to contact Morton Brown, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing, evaluating, or revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Morton Brown shall continue to rely on the accuracy of the information that you have provided. Morton Brown is neither a law firm, nor a certified public accounting firm, and no portion of the content should be construed as legal or accounting advice. A copy of Morton Brown’s current written disclosure Brochure discussing our advisory services and fees continues to remain available on our disclosures webpage. Please Note: Please advise us if you have not been receiving account statements (at least quarterly) from the account custodian.